Insurer accelerates financial close and reporting processes, reducing costs by 75%.

The Challenge

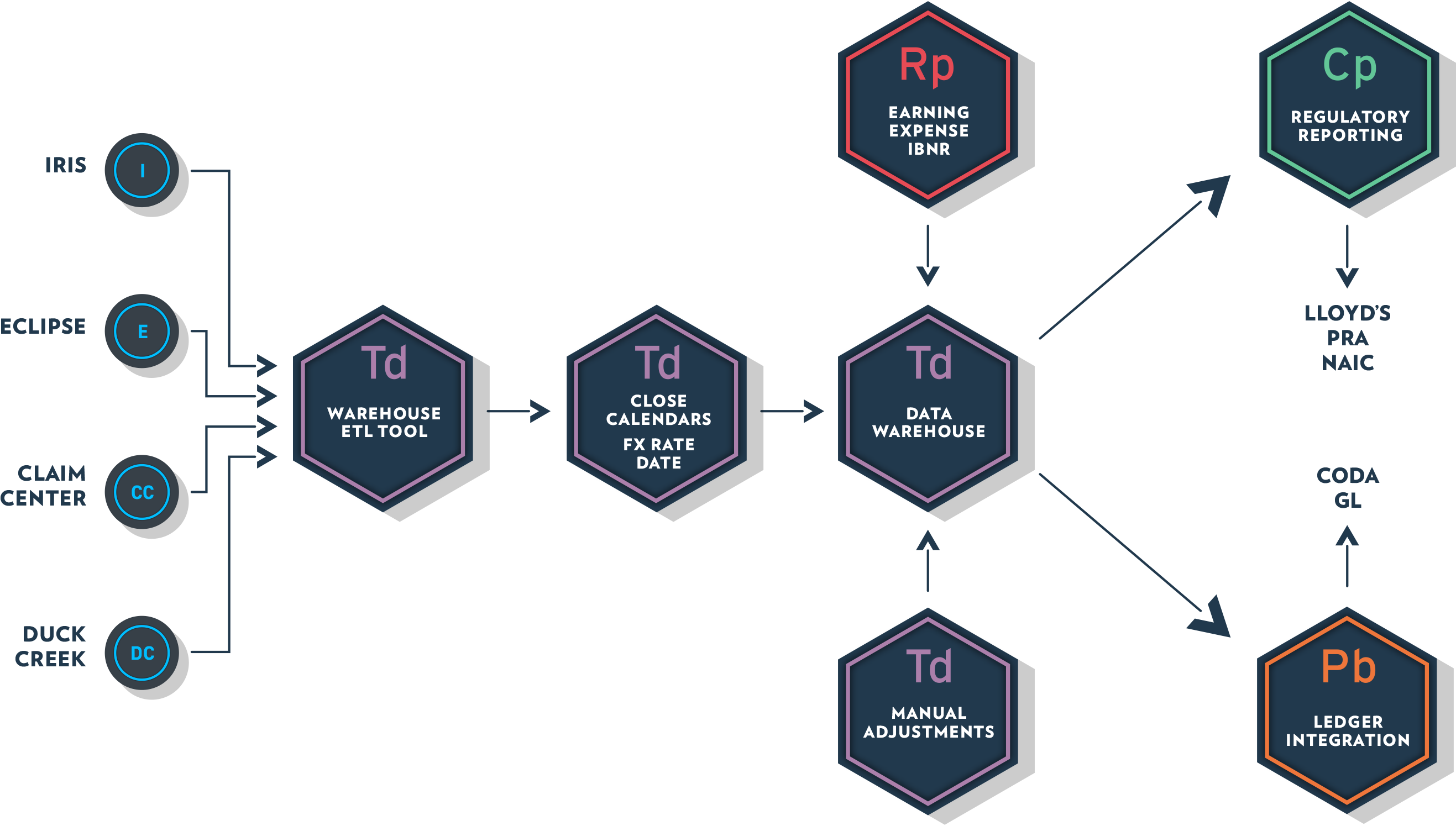

With numerous acquisitions over the last three decades and with thousands of staff in multiple offices around the world, this company’s growth had created a financial accounting landscape comprising a range of disparate data sources, processes, controls and reporting methods.

With no central data warehouse, data was stored in multiple source systems. This meant that people and resources were preoccupied with manually intensive data collection, recording and reporting processes which became increasingly onerous as regulatory and statutory reporting requirements placed ever greater demands on the business.

The result

Phinsys was utilised to develop a single source of truth; to create a reliable data model that supports enterprise-wide Group, Entity, Regulatory and Statutory reporting requirements. The implementation of a consistent and accurate financial close process enabled the efficient use of resources and reduced operating expenses.

The time dedicated to consolidated reporting across the entire portfolio including PRA and Lloyd’s Solvency II Pillar 3, UK & US GAAP was reduced from 20 days to five days. There was an overall 85% reduction in effort to run regulatory reporting after the close of statutory books and no time-lag between the production of management and regulatory reports.

We’ve been able to create a single source of truth and standardise the processes for our financial and actuarial insurance accounting. Fast, accurate automation has reduced manual processing, eliminating the need to increase headcount and has reduced operating costs across the entire group.