Managing General Agent aspires to become a full stack insurance company.

The Challenge

Many Managing General Agents (MGAs) in today’s evolving InsureTech landscape aspire to become a full stack insurance company. Some also enable start-ups by allowing them use of their technology platform and distribution network to develop new and innovative insurance products.

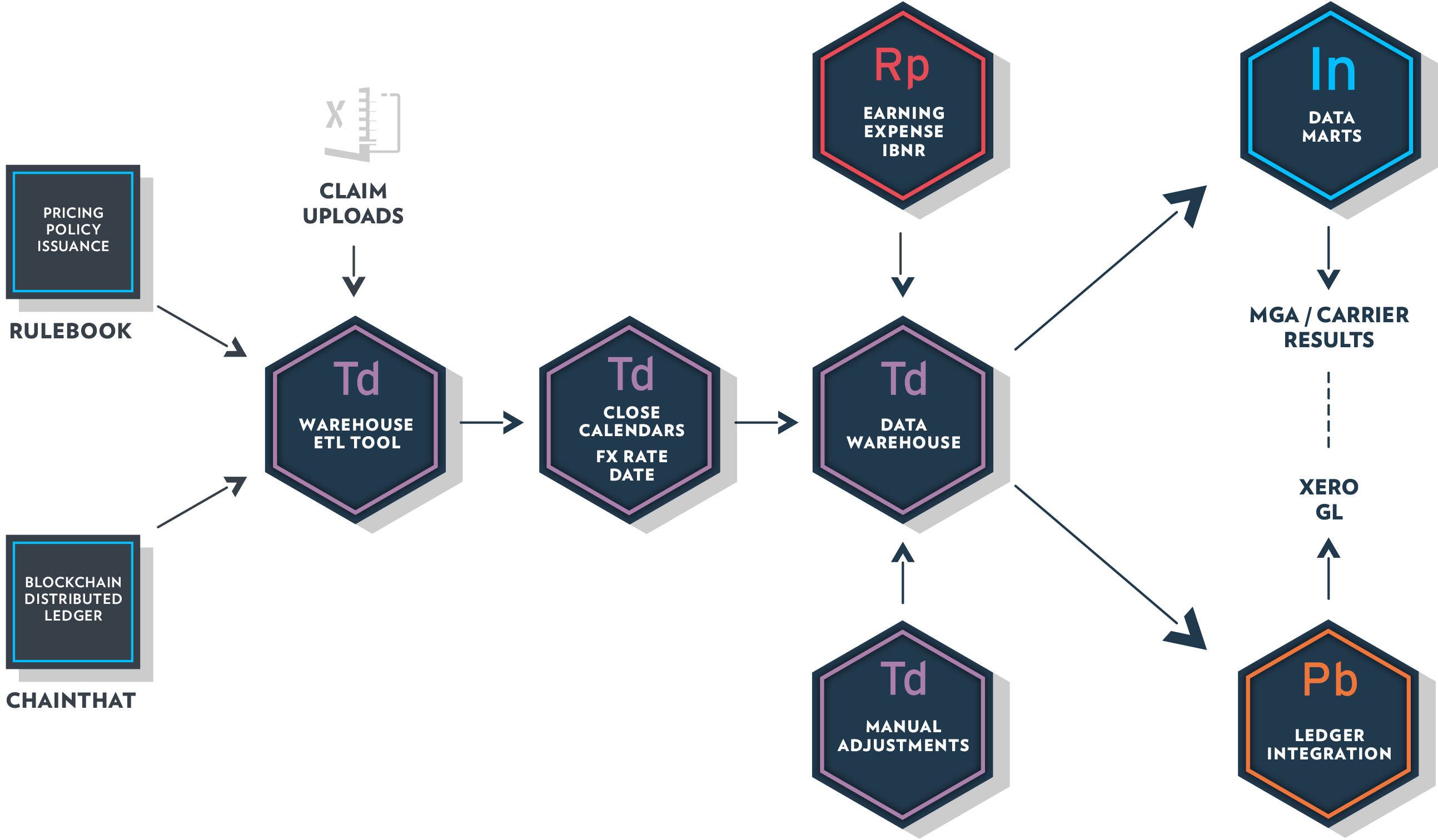

This MGA needed a complete data warehouse specifically designed for a full stack insurance company, while also supporting the unique requirements of an MGA and carrier relationship.

The data warehouse needed to take data from both a pricing and policy issuance system as well as a distributed ledger that managed cash settlements.

The result

Phinsys implemented an insurance data warehouse that supports current and future regulatory and statutory needs within a three-month project schedule.

This MGA can now run full earnings-based carrier P&L statements to model their insurance results as well as standard MGA accounts, all from the same source data.

Data easily and reliably produced from the Phinsys platform was recently utilised during investment discussions to explore a host of growth and investment opportunities.

By implementing the Phinsys product suite we can now model full product statutory results as if we were an insurance company. Building a reliable and valuable data source for future opportunities has allowed us to properly structure capital provider agreements by balancing up-front commission rates with longer-term profit commission incentives.