Global Insurer combined three international operations into a single consolidated financial close.

The Challenge

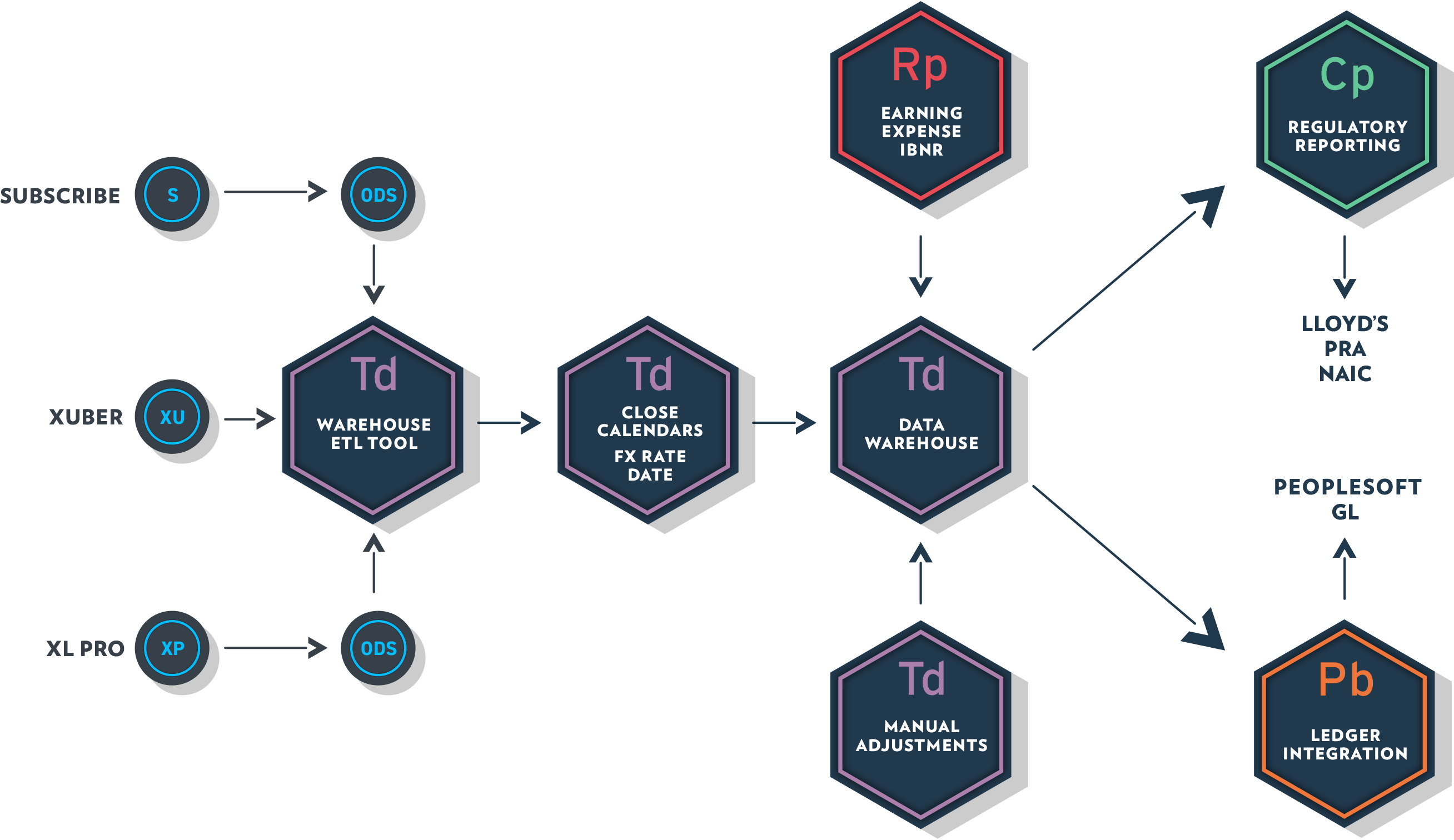

This company’s growth had resulted in the purchase and creation of local insurance subsidiaries. These subsidiaries had their own local regulatory reporting requirements and accounting standards; however, the company still needed to consolidate all results to a corporate US GAAP equivalent. Their technology landscape evolved to have separate data warehouse and financial systems purchased specifically to support these local subsidiaries.

Due to the variations in accounting standards between the US GAAP parent and local entity reporting, the finance team spent a significant amount of resources balancing financial statements between group companies.

The result

A consolidated US GAAP financial result could now be produced simultaneously along with local reporting requirements which utilised different earnings patterns and calendar closing dates. This provided a clear an auditable ability to tie complex group results together.

Three local reporting platforms were decommissioned resulting in $750K of annual savings to the company.

Staff resources previously allocated to manually producing accounts and performing inter-company reconciliations were reassigned to other analytical functions providing value to the organisation.