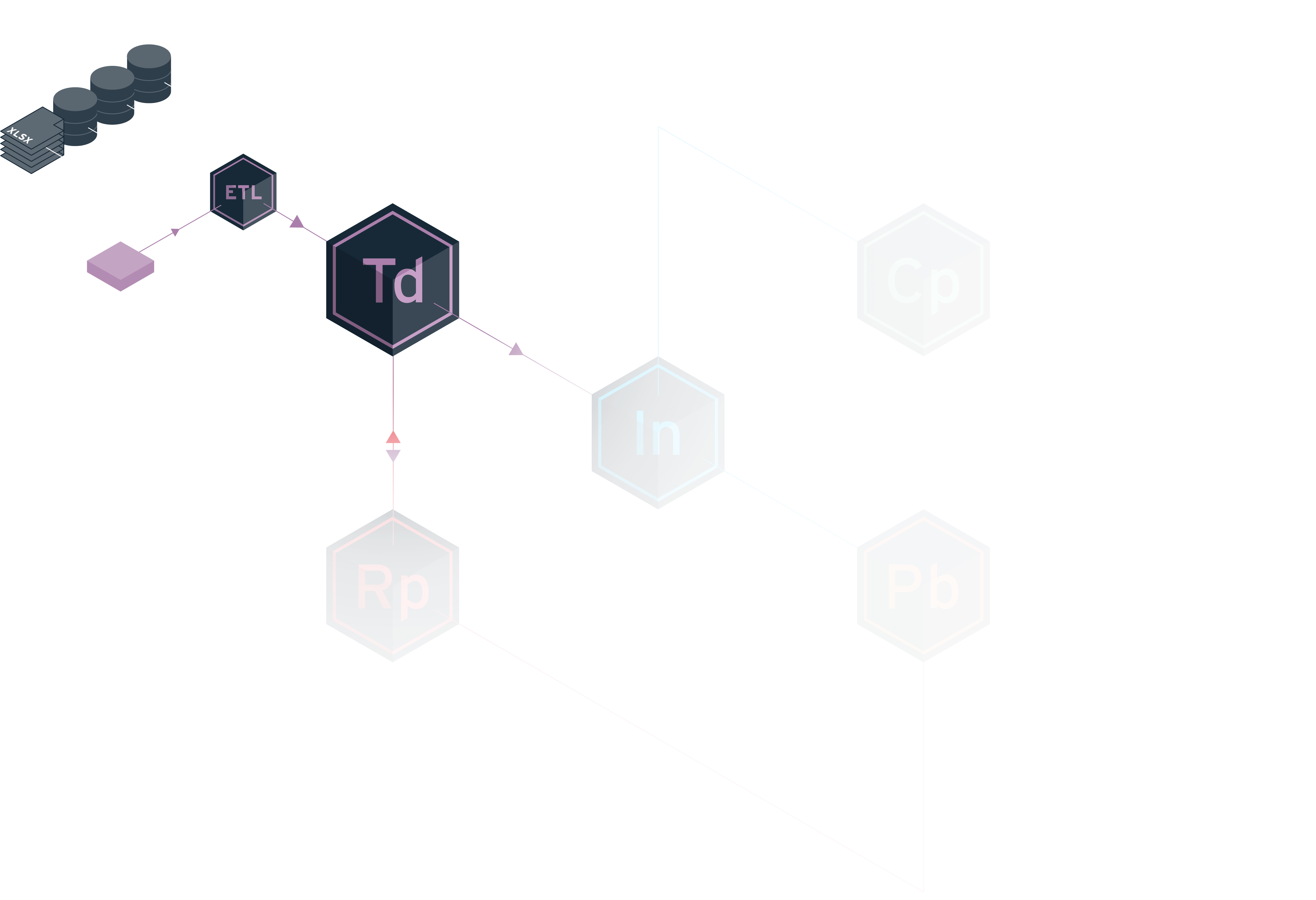

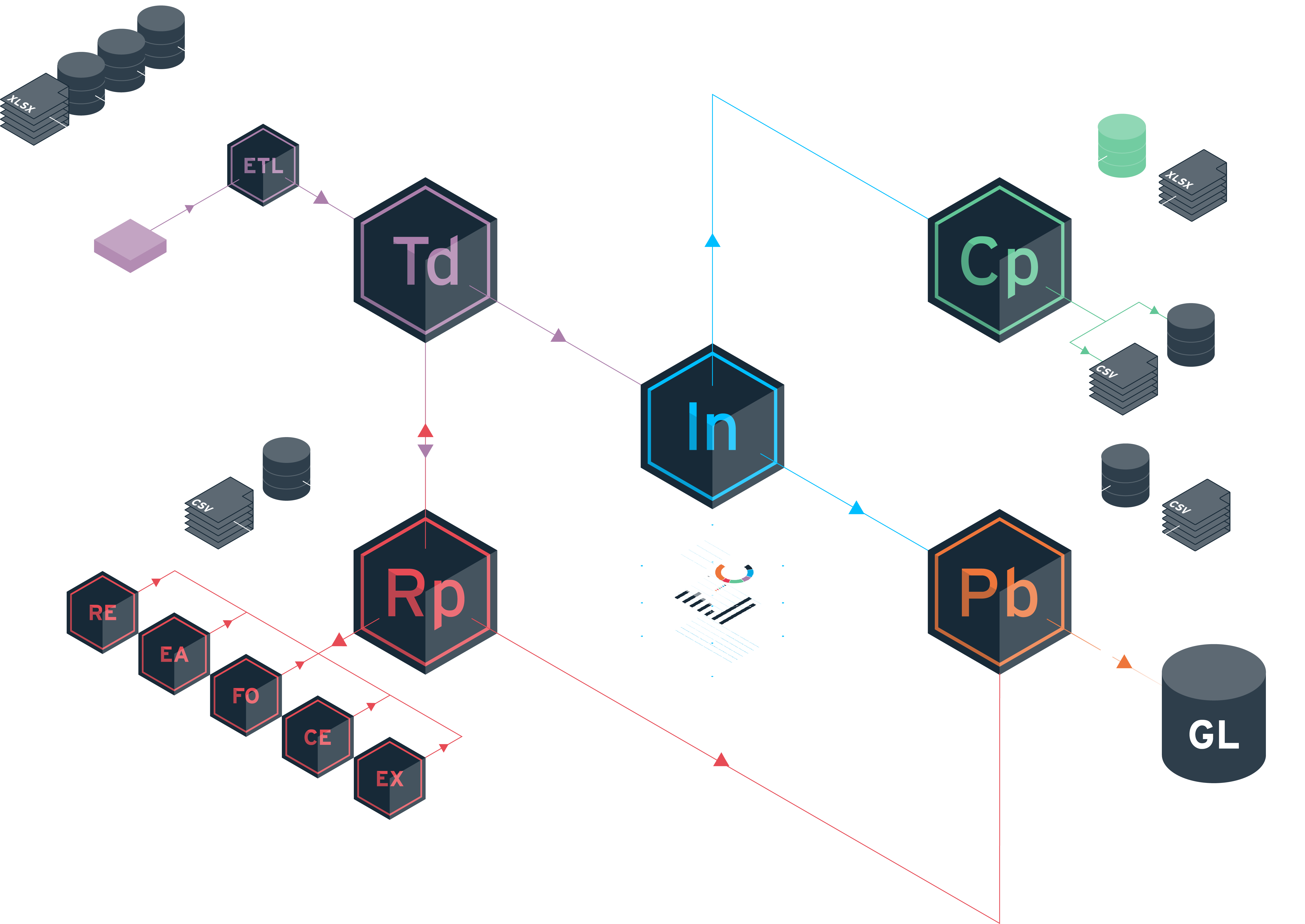

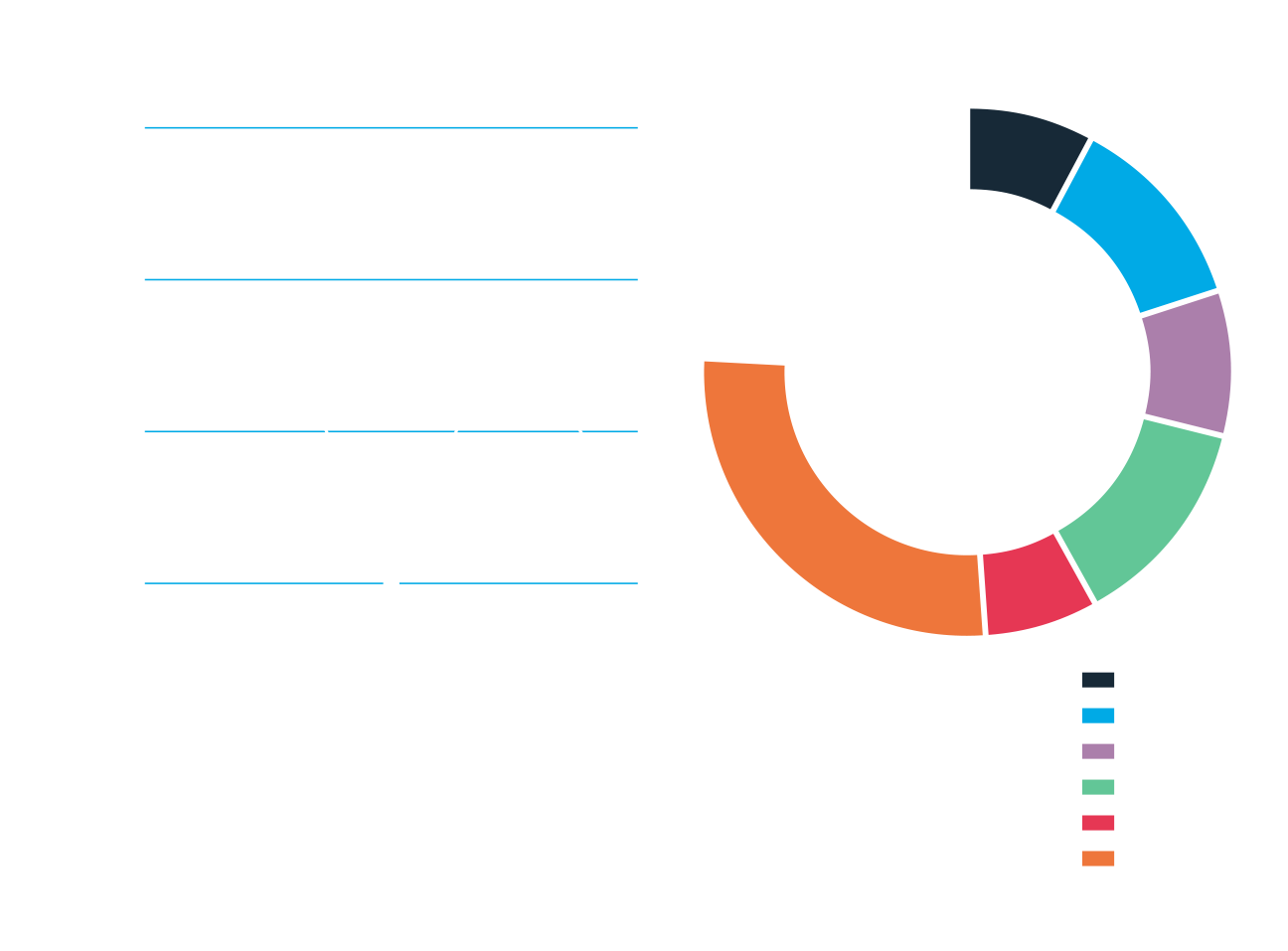

Against a background of ongoing change and an ever-more complex regulatory environment, it is essential for insurers to be able to produce financial data quickly, reliably and accurately. Existing IT systems fall short, and manual processing is onerous and time-consuming. Tandem provides the perfect flexible solution.

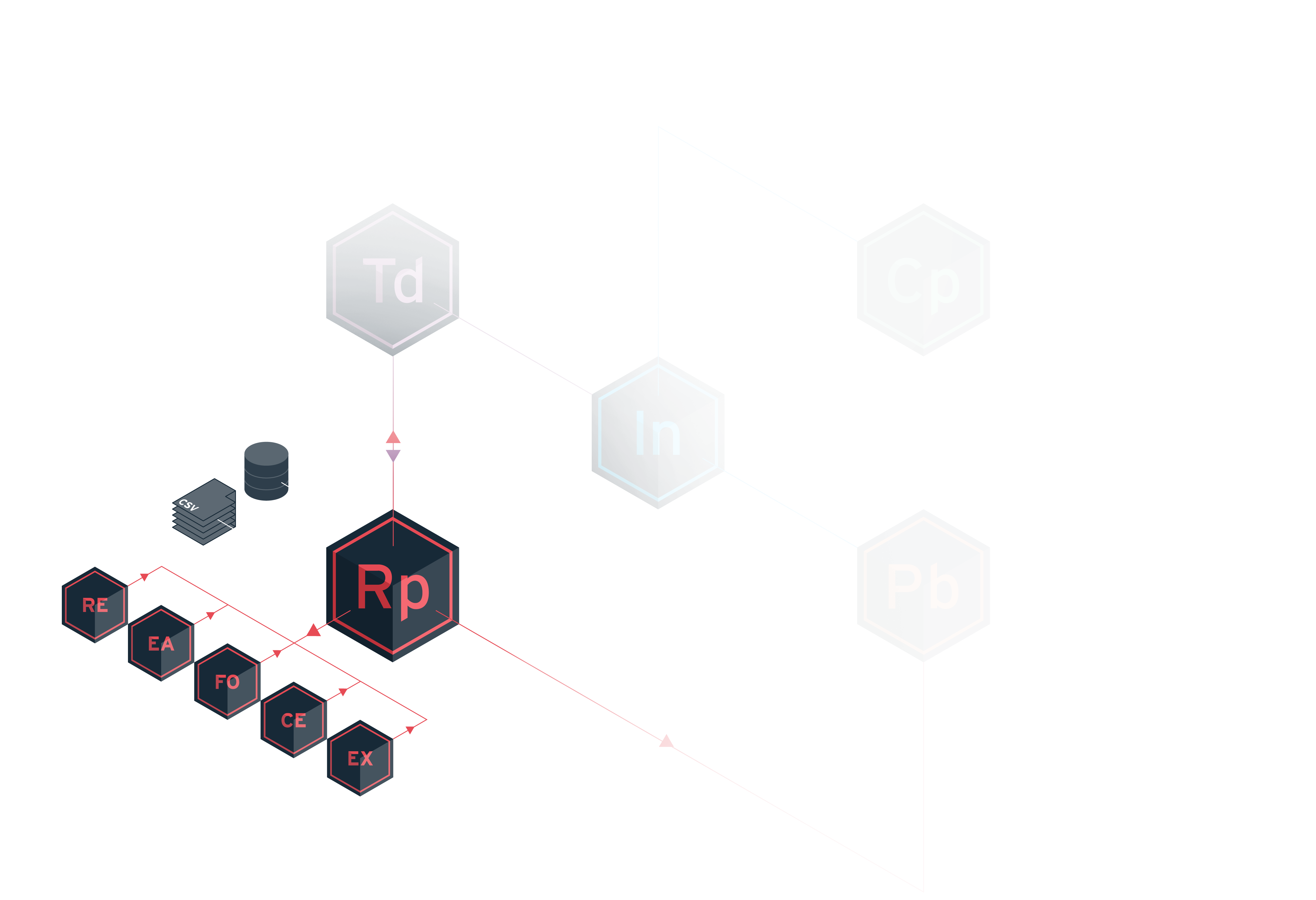

Finance departments often rely on creating complex spreadsheets and tactical IT solutions to solve laborious and time-consuming tasks in the preparation of reporting returns and the consolidation of business results. Rapport puts a stop to such layered complexities and provides a flexible solution to whatever processing is required.

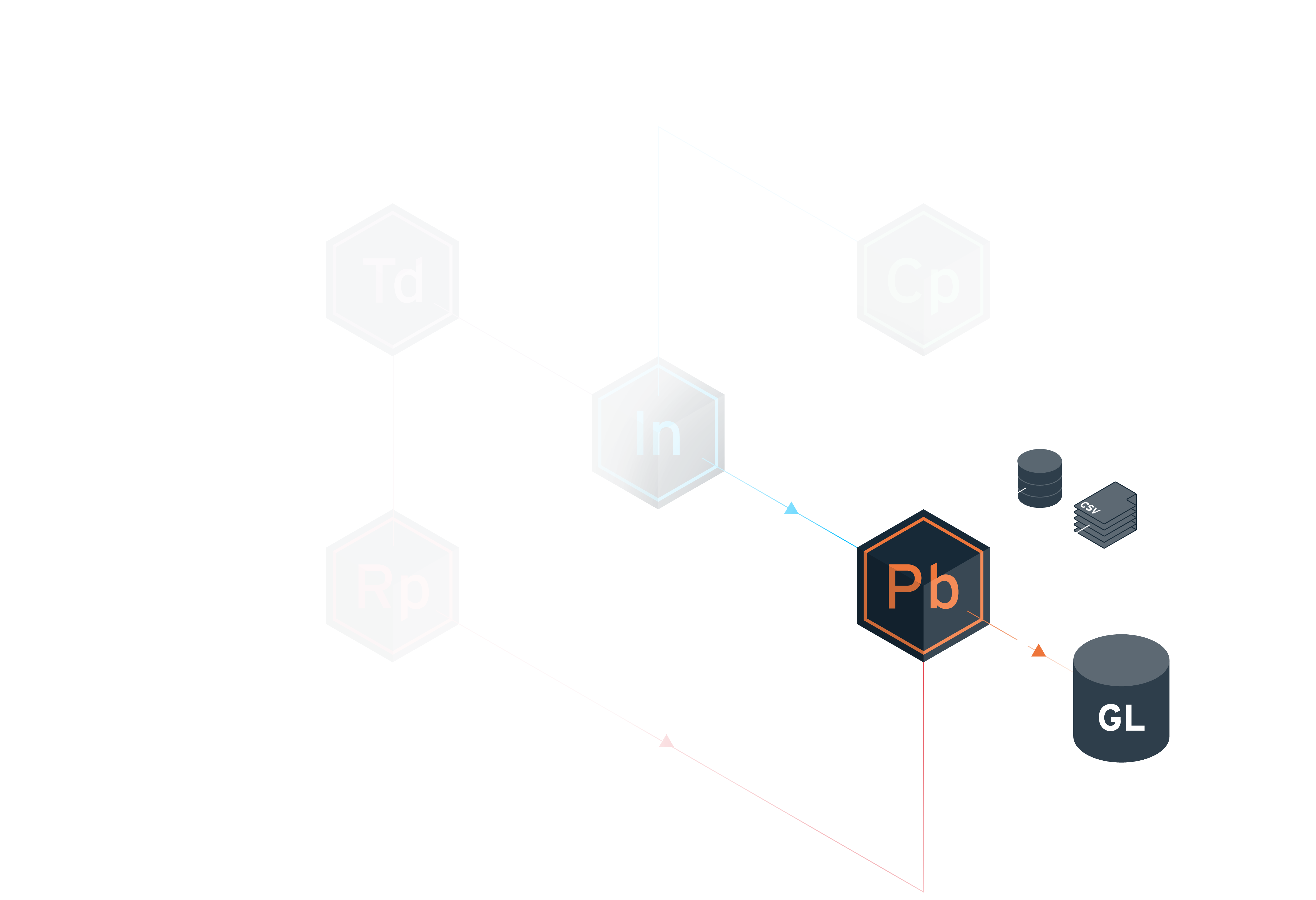

As insurers develop their operations, it is increasingly important that they can integrate new businesses into their finance systems seamlessly and efficiently. Often integration will be required to one or more GL packages, for local and corporate reporting. Postbox provides the ideal architecture.

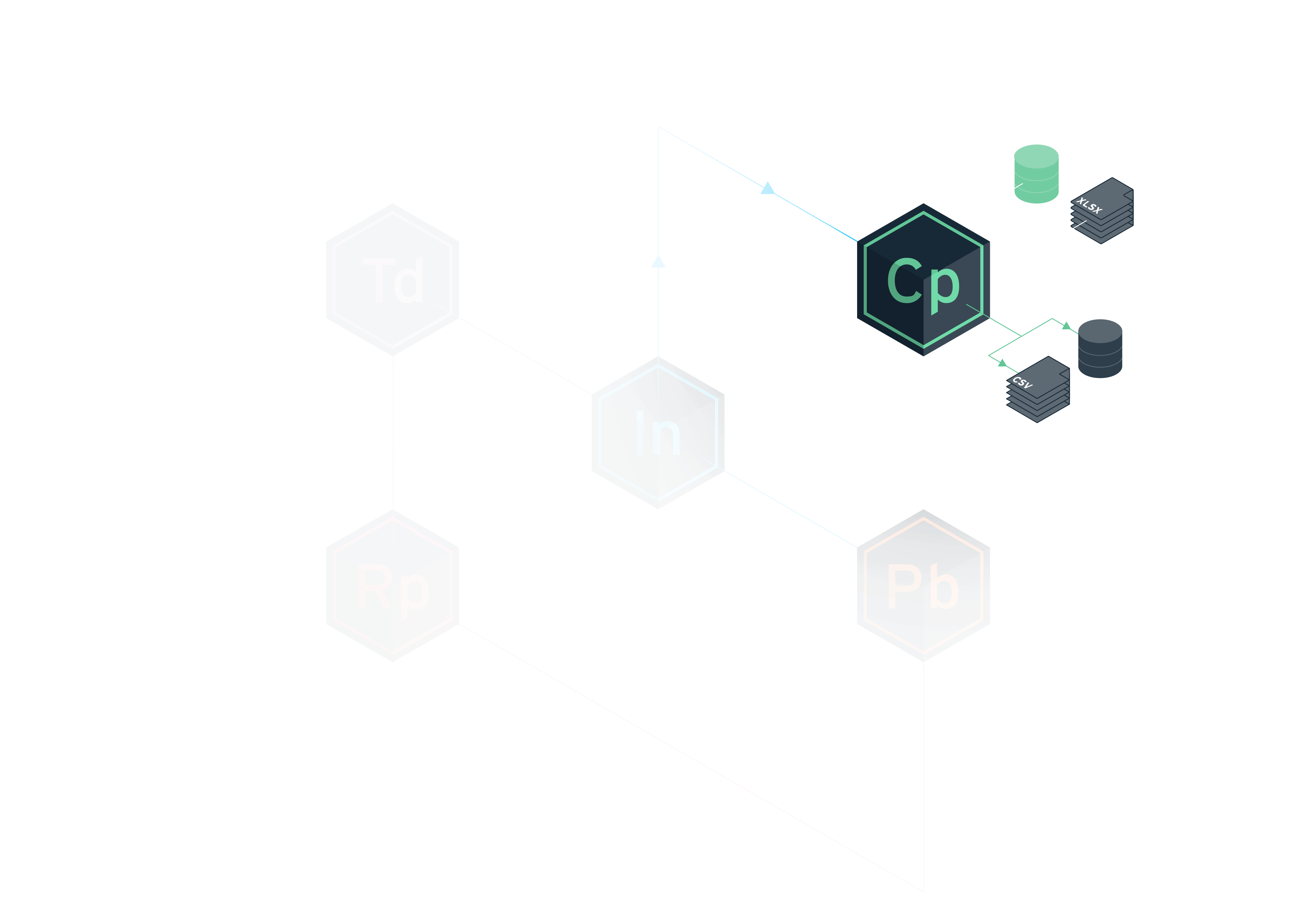

Insurers’ reporting timetables are becoming increasingly demanding and the finance function is being asked to do more, more frequently and in ever-shorter periods of time. This requires resource from the finance and actuarial departments to prepare, analyse and then present the data in the required formats. Comply provides the ultimate compliance and auditing solution.

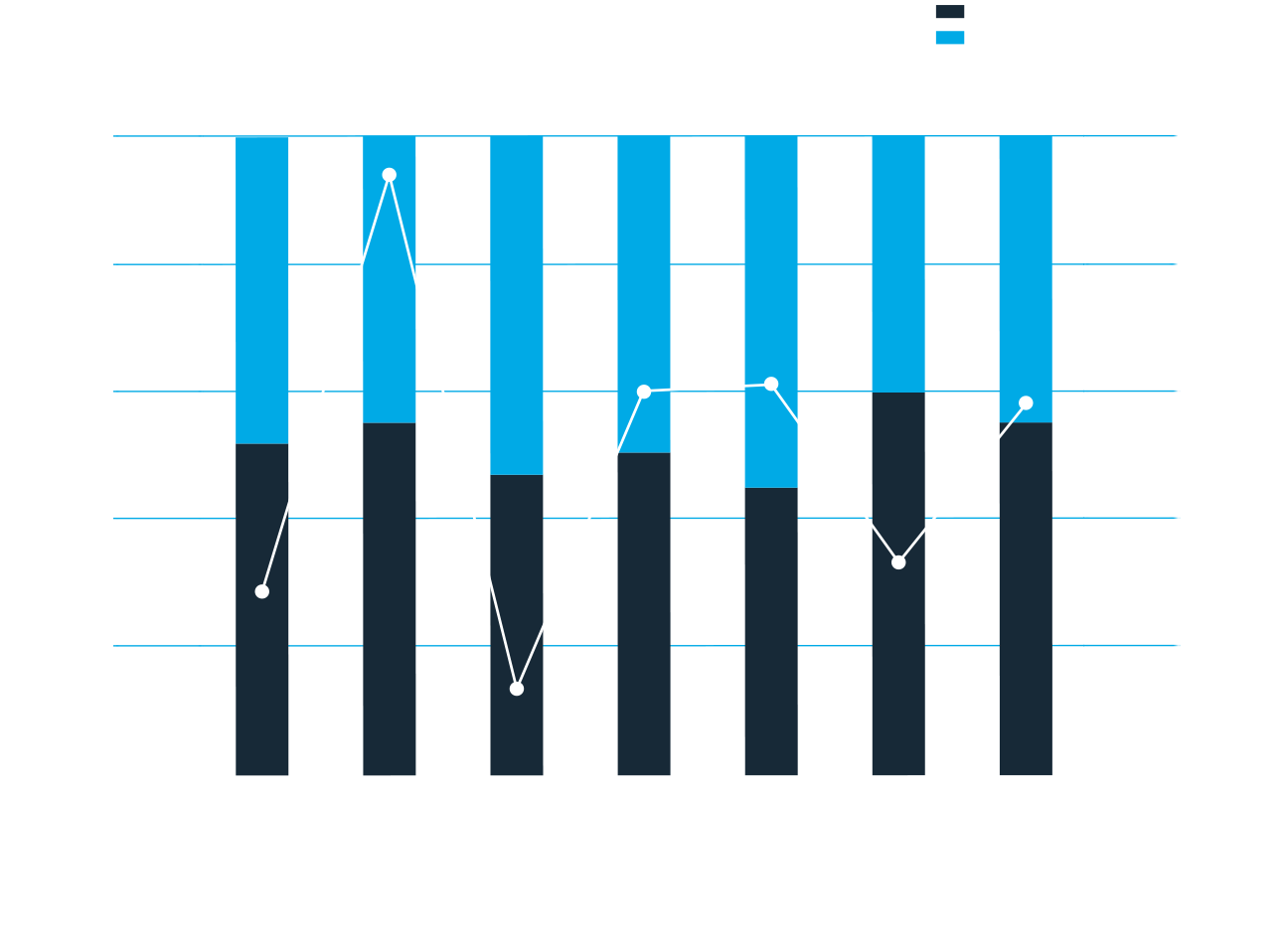

Having inconsistent financial management information across the organisation results in untrusted reports and user-built analyses. The conflict that results from this takes significant management time and removes clarity around performance, decisions and impacts of change. Inform solves these issues and provides information in formats ideal for each department’s management team to understand and present.

Against a background of ongoing change and an ever-more complex regulatory environment, it is essential for insurers to be able to produce financial data quickly, reliably and accurately. Existing IT systems fall short, and manual processing is onerous and time-consuming. Tandem provides the perfect flexible solution.

Finance departments often rely on creating complex spreadsheets and tactical IT solutions to solve laborious and time-consuming tasks in the preparation of reporting returns and the consolidation of business results. Rapport puts a stop to such layered complexities and provides a flexible solution to whatever processing is required.

Insurers’ reporting timetables are becoming increasingly demanding and the finance function is being asked to do more, more frequently and in ever-shorter periods of time. This requires resource from the finance and actuarial departments to prepare, analyse and then present the data in the required formats. Comply provides the ultimate compliance and auditing solution.

As insurers develop their operations, it is increasingly important that they can integrate new businesses into their finance systems seamlessly and efficiently. Often integration will be required to one or more GL packages, for local and corporate reporting. Postbox provides the ideal architecture.

Having inconsistent financial management information across the organisation results in untrusted reports and user-built analyses. The conflict that results from this takes significant management time and removes clarity around performance, decisions and impacts of change. Inform solves these issues and provides information in formats ideal for each department’s management team to understand and present.