Phinsys Chief Delivery Officer Neil Greenacre explains how a loss of control over critical finance data and reduced capacity to meet filing deadlines could severely impact business performance.

How many insurers can say with confidence that their finance function hasn’t slowed over the last few weeks, or that they aren’t struggling with the new reality of key staff remote-working? Or how a loss of control over critical finance data and reduced capacity to meet filing deadlines isn’t creating problems that could severely impact business performance or threaten their very survival?

While some may view these as short-term problems, the ‘new normal’ of remote working could be the catalyst for many insurers to digitally re-engineer the way they operate for the future.

For many, the inefficiency and expense of their back-office operations has been brought into sharp focus by recent events and nowhere is this more true than in the finance function.

Quarter-end is tough enough for insurance finance teams up against tight reporting deadlines and with 1Q close fast approaching, the prospect of managing the whole process remotely will be daunting for many and potentially adds another layer of stress and complexity.

The late nights at quarter-end, working side-by-side mulling over multiple spreadsheets and manually reconciling data from multiple sources, are no longer possible for finance teams. And even if regulators allow more time for reporting and insurers’ various boards, and committees are temporarily understanding of delays in receiving accurate financial data, will this patience persist further down the line in the crucial 4Q?

The current crisis has quite rightly focused minds on insurers’ operational resilience and their ability to continue key functions during an extended period of adversity without interruption. Many insurers will rest easy knowing that underwriting and claims systems, in which so much time and money have historically been invested, will adapt and respond to remote working. But what of the finance function which has historically been overlooked when it comes to technology investment?

Perhaps now, as the pressure increases on finance teams across the industry, it’s time for insurers to invest in technology that, not only sees them through the current crisis and the rest of 2020, but also acts as a driver for enterprise-wide transformation, creating a digital operating model that improves efficiency, reduces cost and builds resilience for the future.

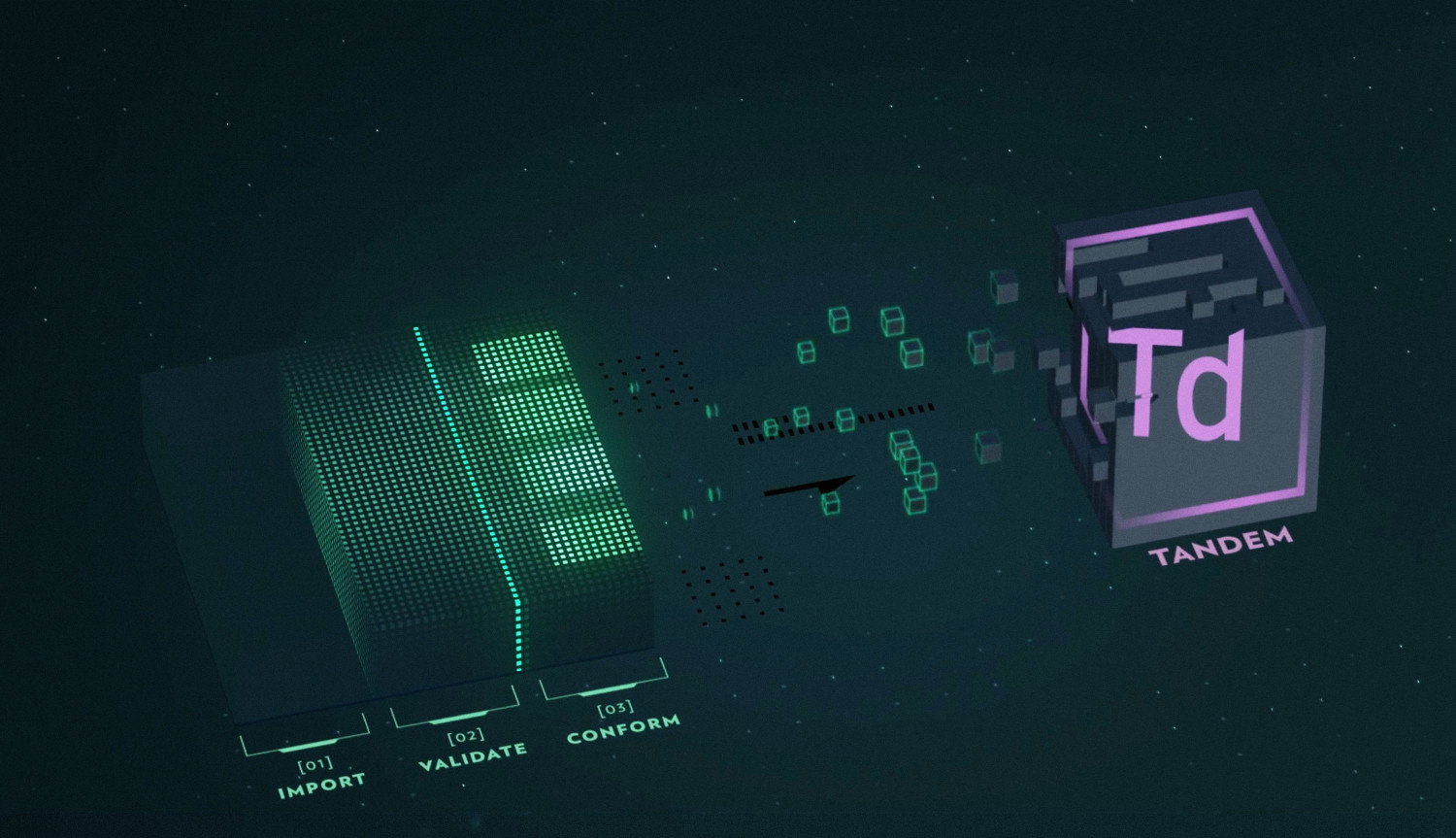

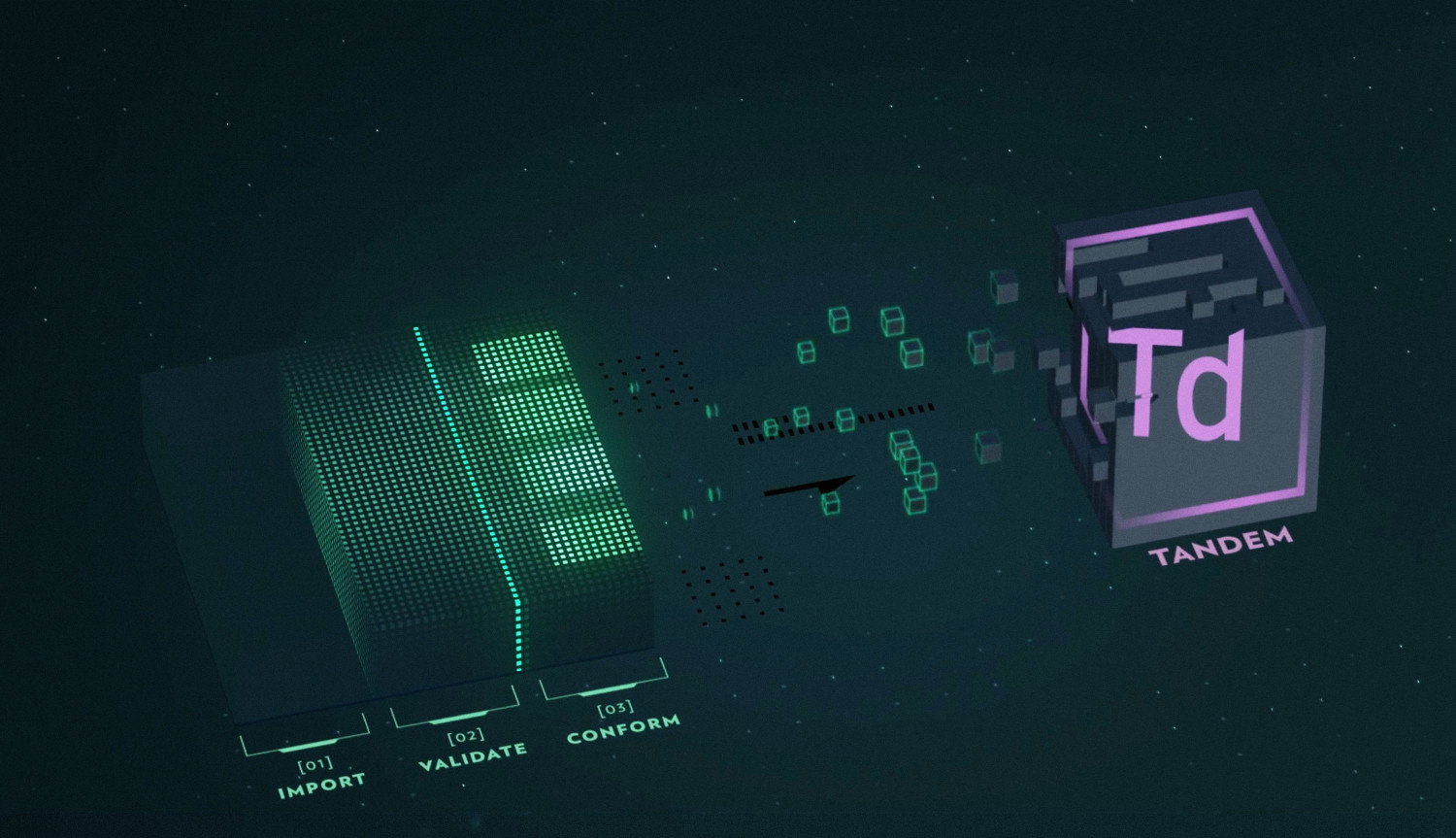

Footnote: Title image is from our Comply product video, illustrating how managed and processed data is fed downstream into other systems, in this case back into our Tandem data warehouse. Learn about our Full Suite of products here.