Phinsys, the leading finance automation software provider for the (re)insurance sector, has been selected by Inigo Limited (“Inigo”), the dynamic technology-driven speciality insurance business, to deliver a digital, optimised finance and accounting function.

This new partnership with Inigo underscores Phinsys' track record of delivering innovative software solutions for all types of insurance enterprises. With a rapidly growing portfolio of clients in the UK, US and Bermuda, Phinsys has emerged as a driving force for digital finance transformation and efficiency in the industry.

Designed to speed up financial reporting and increase data accuracy, the platform delivers management, statutory and regulatory reporting, including UK and US GAAP, Solvency II and IFRS 17. The Phinsys platform will enable Inigo to make informed and forward-thinking decisions that help shape the future of its business, enhance efficiency and enable further sustained growth.

Stuart Conibear, Chief Commercial Officer at Phinsys, commented:

"Inigo's focus on data science and digital transformation resonates perfectly with our vision of harnessing technology for smarter financial control. Phinsys remains committed to delivering advanced solutions to companies throughout their evolution, and we look forward to working with Stuart and his team in supporting Inigo's continued growth."

Stuart Bridges, Chief Financial Officer at Inigo, said:

"Inigo's vision is to create a fully digital insurer with data science at its core. The Phinsys platform plays a crucial role in helping us achieve this goal, providing us with state-of-the-art tools and technology needed to enhance our data and streamline our financial processes and reporting."

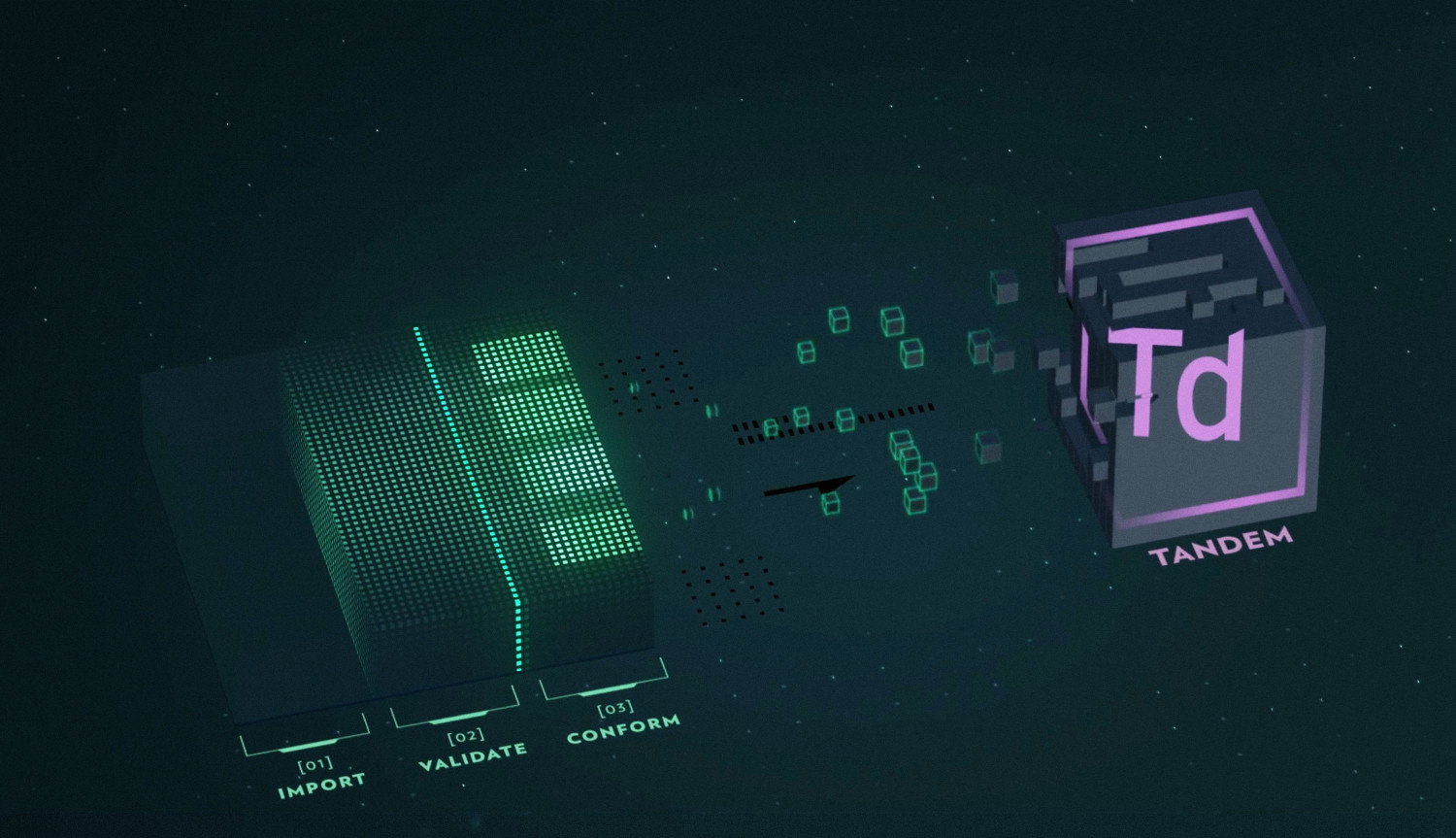

Phinsys software enables insurers to conform data from multiple disparate systems into a single, scalable finance data warehouse and automatically reconcile and post accounting entries to any general ledger. The accuracy and transparency of accounting processes such as expense allocations, IBNR calculations and the planning and forecasting of results are also improved, together with automated regulatory and management reports that enable insurance businesses to understand better where to invest their time and money.