Phinsys, the leading finance automation software provider for the insurance sector, announced today that Ambac Financial Group, Inc. ("Ambac") is implementing the Phinsys suite of finance and accounting products to support the continued growth of its subsidiaries, Everspan Insurance Company and Everspan Indemnity Insurance Company (collectively “Everspan”).

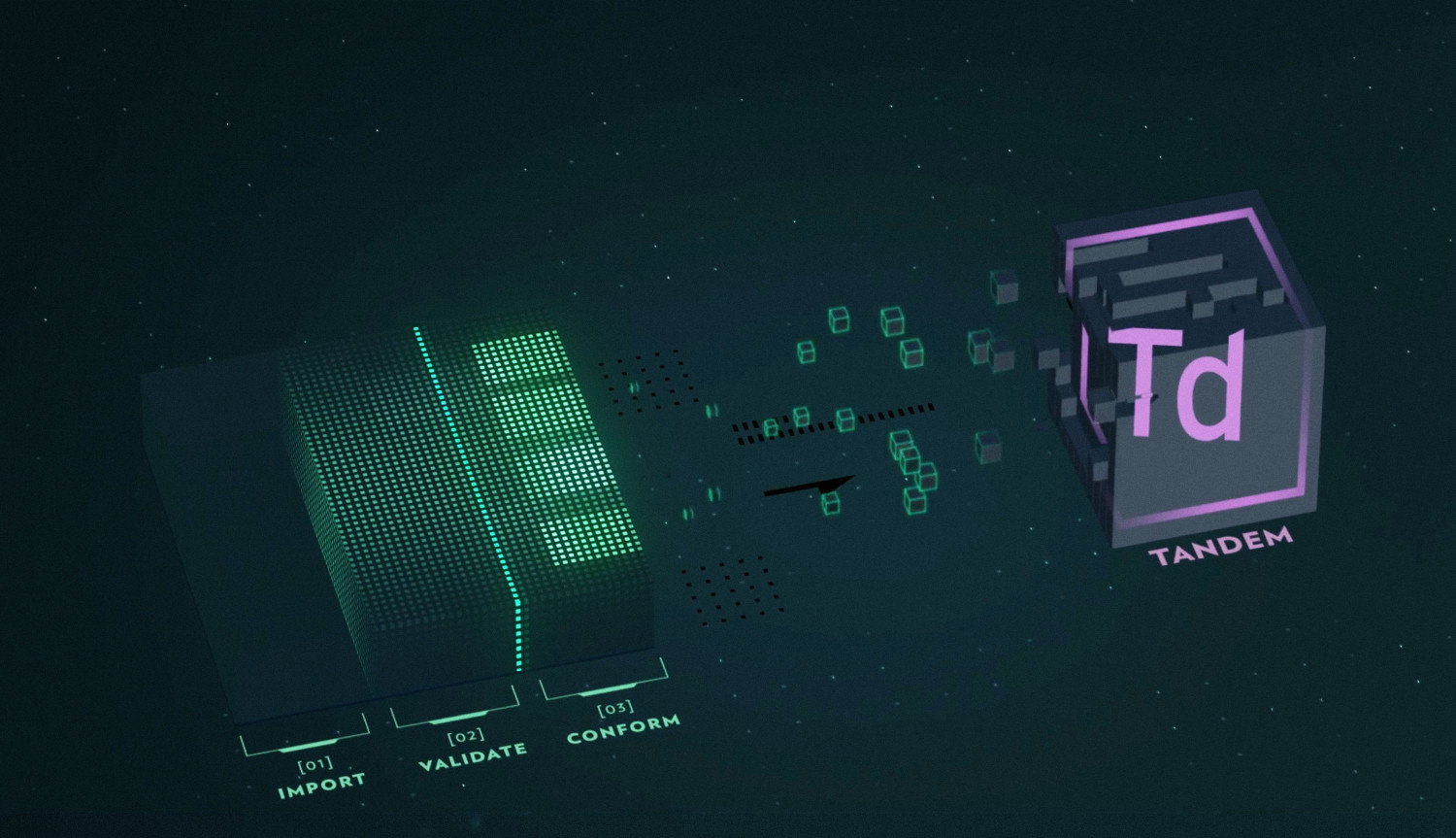

Ambac has licensed the full suite of Phinsys products to support the quick onboarding of partners into Everspan’s growing stable of specialty program insurance business. Phinsys will enable the creation of a single, accurate dataset from which automated finance, accounting and reporting processes will streamline the way in which Everspan operates and manages its portfolio.

Dan McGinnis, chief operating officer of Ambac, said:

“Our goal is to develop a capital efficient specialty P&C insurance platform where technology plays a key role in the active oversight and performance management of our various portfolios. The Phinsys suite of products will allow Everspan to efficiently integrate new MGA and TPA partners, making us easier to work with and improving our customer service”.

Eric Butler, director Americas & Bermuda of Phinsys, commented:

“The Phinsys suite provides a low-code, highly configurable web-based solution that not only improves the efficiency of Everspan’s finance function, but also delivers accurate, reliable financial data on how their portfolios are performing in real-time. We’re delighted to be working with the Everspan team and to be part of their journey as they continue to build out their business.”

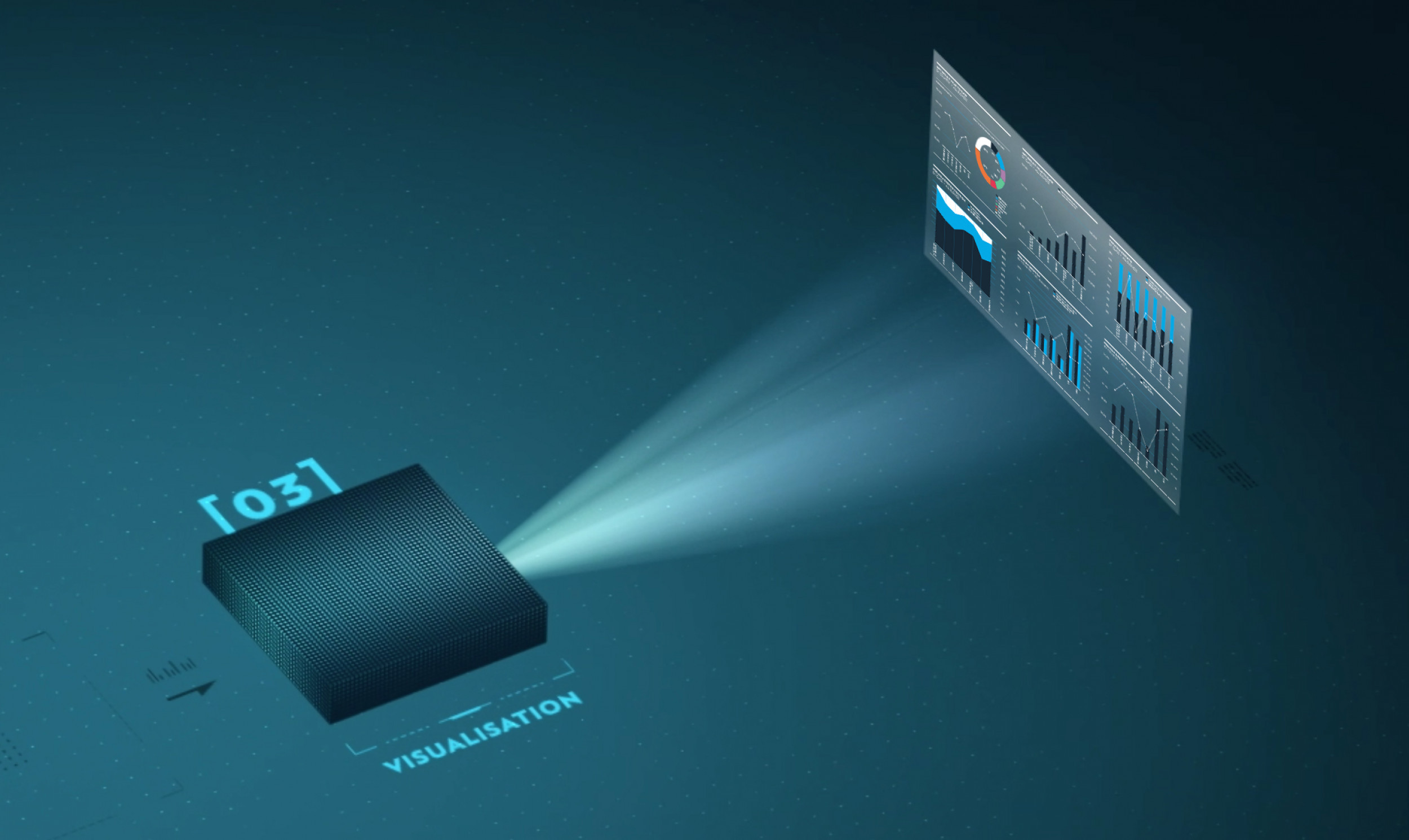

Phinsys software enables insurers to conform data from multiple disparate legacy systems into a single, scalable finance data warehouse and automatically reconcile and post accounting entries to their general ledger. The accuracy and transparency of accounting processes such as expense allocations, IBNR calculations and the planning and forecasting of results are also improved, together with automated regulatory and management reports that enable insurance businesses to better understand where to invest their time and money.